Recently, I was talking to a group about which technology is most important for addressing climate change. With the caveat that we will definitely need a number of solutions to truly meet the challenge, my personal choice would be batteries.

This might not come as a surprise since I’m almost always talking about batteries.

Batteries will transform transport and can also be essential for storing renewable energy, such as wind or solar, for times when these resources are not available. Therefore, in a way, they are a central technology for the two sectors responsible for the majority of emissions: energy and transport.

And if you want to understand what’s coming next for batteries, you need to look at what’s currently happening with battery materials. The International Energy Agency has released a new report on the state of energy-critical minerals, which contains some interesting information related to batteries. So let’s delve into some facts about battery materials.

So what’s new in battery materials?

It’s probably not news to you, but electric vehicle sales are growing rapidly — they accounted for 14% of global new vehicle sales in 2022 and will reach 18% in 2023, according to the IEA. This global growth is one reason we at MIT Technology Review put “the inevitable EV” on our list of game-changing technologies this year.

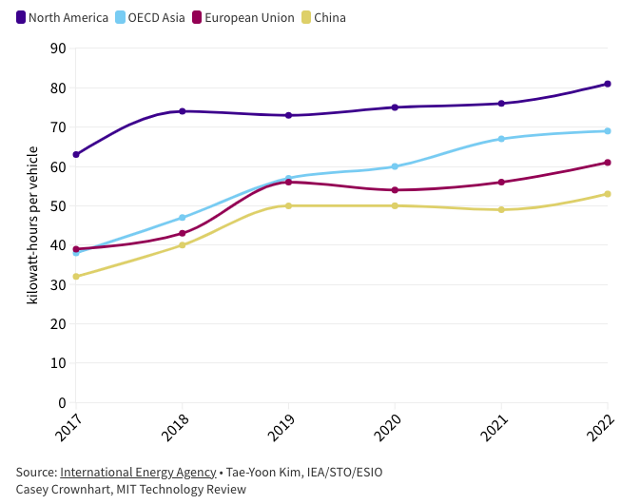

Add to the constant growth of the market the fact that, around the world, electric vehicle batteries are getting bigger. That’s right, not just in the USA, which is famous for its huge vehicles. The US is still the leader in average battery capacity, but battery size inflation is a worldwide phenomenon, with Asia and Europe seeing a similar or even more dramatic jump in recent years.

Average Battery Size for Electric Passenger Vehicles

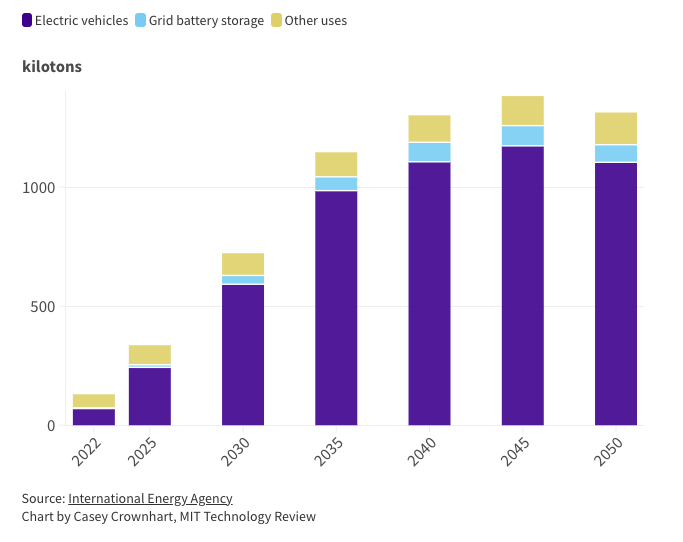

Add in the growing demand for electric vehicles, increasing battery capacity around the world, and the role that batteries can play in grid storage, and it’s clear that we’re about to see a huge increase in demand for the materials needed to make batteries.

Take lithium, for example, one of the main materials used in lithium-ion batteries today. If we want to build enough electric vehicles to achieve net-zero emissions, demand for lithium will increase about tenfold between now and 2040. Lithium is one of the most dramatic examples, but other metals such as copper and nickel will also be in high demand in the coming decades.

Total lithium demand under net-zero emissions scenario

We will not run out of any of the materials needed to generate renewable energy, as I wrote earlier this year. Batteries may be a more difficult scenario, but generally speaking, experts say we have enough resources on the planet to make the batteries we need. And with battery recycling increasing, we should reach a point where there is a stable supply of old battery materials.

But we’re already starting to see what dramatic increases in materials demand could mean in the near term for the battery market. Recently, prices for lithium and some other metals have seen big increases as battery makers scramble to meet immediate demand. This caused lithium-ion battery prices to rise last year for the first time.

What does all this mean?

Therefore, we are seeing a huge increase in demand that is only going to continue, and while there will be enough materials in the long term, there may be some short-term scrambling for purified and processed battery materials. This will shape the world of batteries going forward and there are a few ways this could happen:

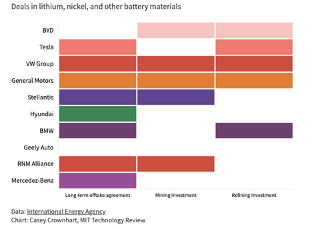

First, automakers will get even more involved with the raw materials they need to make batteries. Their business depends on having these materials consistently available, and they are already taking steps to secure their own supply.

As of 2023, all but one of the world’s top 10 electric vehicle manufacturers have signed some type of long-term purchasing agreement to secure raw materials. Five invested in mining, five invested in refining and almost all of these deals have taken place since 2021.

Involvement of top 10 EV manufacturers in the raw material supply chain

Supply constraints will also drive new battery innovations.

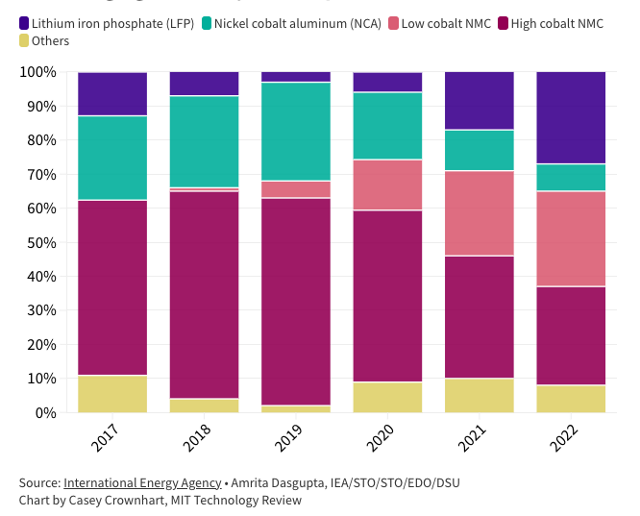

We’ve already seen the beginnings of this: cobalt has been a crucial ingredient in lithium-ion battery cathodes for years. However, the metal is under scrutiny because its mining has been widely linked to forced and child labor.

In recent years, technology giants and electric vehicle manufacturers have begun to commit to using only responsibly mined cobalt. And at the same time, battery makers have begun turning to chemicals that contain less cobalt, or even eliminated the metal entirely, partly in an effort to cut costs.

Lithium iron phosphate batteries do not contain cobalt and have gone from a small fraction of EV batteries to around 30% of the market in just a few years. Low-cobalt options have also gained traction since 2019.

The changing landscape of batteries for electric vehicles

I believe we will continue to see new and interesting options in the battery world, in part due to these material constraints. Iron-based batteries could play an important role in grid-scale storage, for example, and we could also see more sodium-based batteries in cheap electric vehicles soon.

Sources/credit: MIT Technology Review