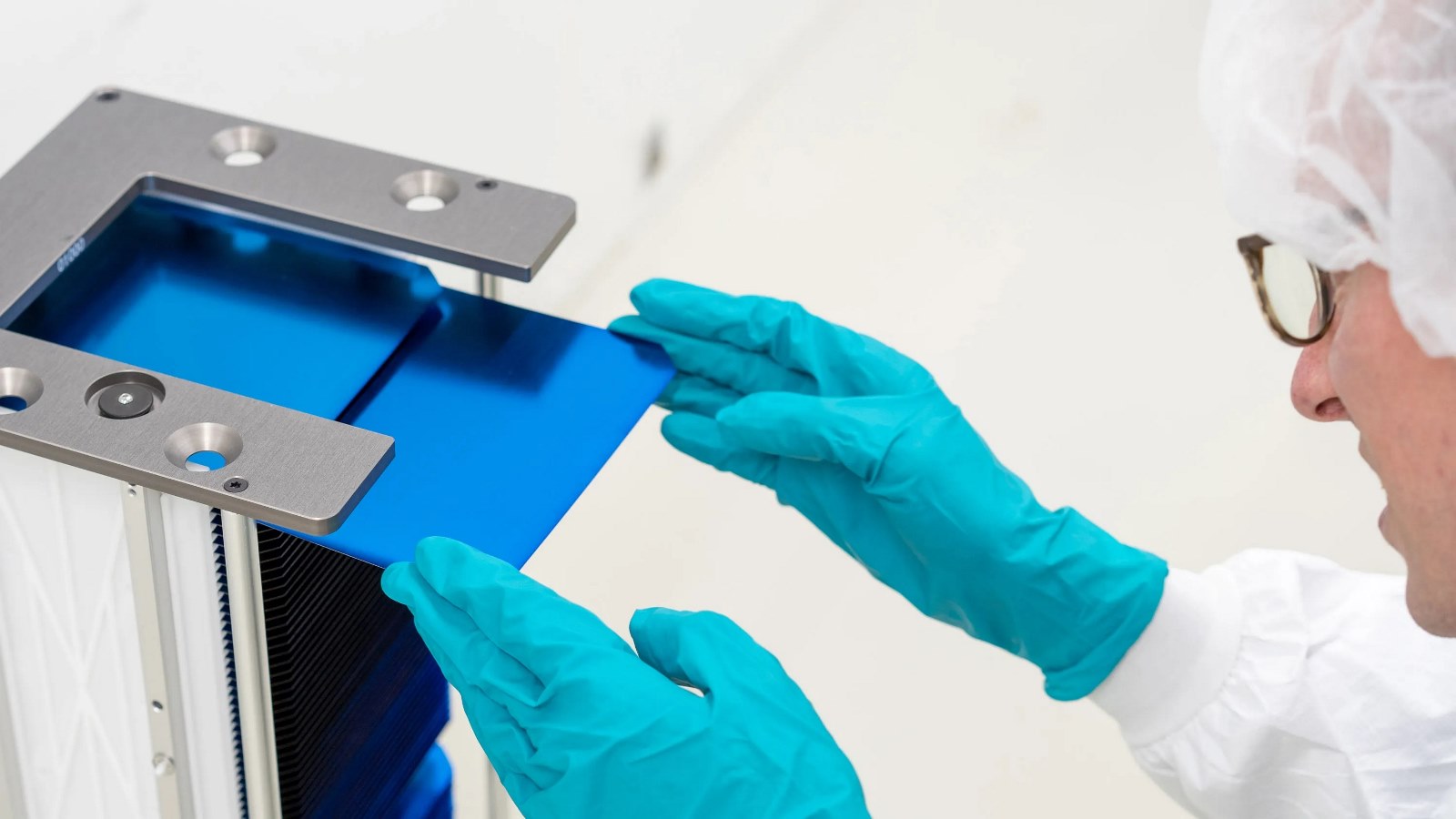

In Swift Solar’s lab, more than a dozen pairs of elbow-length rubber gloves hover horizontally in the air, inflated like arms. The gloves are inflated by nitrogen gas and protrude out of waist-high glass-walled cabinets designed to keep workspaces dry and airtight to protect the delicate solar materials inside.

In one corner, technician Roger Thompson puts his hands on one of the pairs of gloves and begins to fit small sheets of glass onto a metal plate. Soon, a conveyor belt will carry the sign behind a metal door, where the “magic of the black box,” as Swift CEO Joel Jean calls it, will add a chemical coating designed to conduct electrical current.

Swift, which operates this facility in a quiet industrial neighborhood in Silicon Valley, is part of a growing group of companies experimenting with next-generation solar technology. The startup is competing to produce commercially viable solar cells that coat traditional silicon with materials called perovskites.

Stacking these two materials, which absorb different wavelengths of light, allows solar panels to achieve higher efficiencies and produce more electricity per panel. This means that perovskite tandem solar cells could reduce costs and increase the amount of renewable electricity on the grid.

The promise is significant. But companies and scientists have been working with the technology for more than a decade without any commercial implementation. As a solar material, perovskites are fickle — they are sensitive to water, heat and light. And some researchers warn that time may be running out.

“I have a feeling that if in the next two or three years there are no perovskite products, the market could lose confidence in this technology,” says Bin Chen, a research assistant professor who focuses on perovskite technology at Northwestern University.

Researchers and startups, including Swift, are working tirelessly to develop these products, encouraged by recent progress in making perovskites more durable. In recent months, some of the world’s biggest solar companies have also given their confidence to the technology, investing in pilot manufacturing lines or buying perovskite startups.

Now these companies need to prove that they can overcome the difficulties that have plagued perovskites for years and at the same time produce millions of panels with record efficiency.

“On the back” of silicon

Many of these companies believe that the key to perovskites’ success will be integrating them with proven solar technologies, which could give perovskites some of their hard-earned stability and market confidence.

“The main entry point for perovskites into the market is literally on the back of silicon,” says Barry Rand, professor of electrical and computer engineering at Princeton University.

Currently, more than 90% of solar panels sold worldwide are made from crystalline silicon. Decades of experience with this technology means that developers know how to plan projects around it, and financiers know how to price investments for projects that use it.

Applying perovskites to these panels could give solar companies an edge in a highly competitive industry. “If you can crack it — make a better solar module — you’ll make money out of it,” says Jenny Chase, a solar analyst at research service BloombergNEF. “The idea is to make something that is cheaper to manufacture per watt, and then you can sell it at a higher price because it will have quite high efficiency.”

This is easier said than done. Perovskites, which are composed of metal halides and share a unique crystalline structure, face two major challenges: increasing durability and increasing production.

Perovskites can react with oxygen in the air or degrade when exposed to light — a big problem for a solar product. To create perovskite tandems with more stable structures, the companies plan to place layers of perovskite on other solar cells, using evaporation, printing (like ink on a newspaper) and even “spin-coating” — a technique that looks like spin art. 90s. Changing the composition of the perovskite layer could also help them last longer.

Chen and Rand are collaborators on two efforts recently funded with millions of dollars in support from the U.S. Department of Energy to test perovskite-silicon configurations that could be more durable and more quickly commercialized. Other participants include universities, several perovskite startups (including Swift) and the US National Renewable Energy Laboratory.

Staying strength

Rand, whose team at Princeton studies how to keep perovskites from degrading, says the field has evolved a lot in the last seven years. Current panels are better encapsulated to keep water out. Now, he says it’s simply a game of elimination—determining which chemical components in a cell are most likely to react and switch them. But he doesn’t think carrying out more experiments should impede commercialization.

“I think the results are promising enough to make these investments,” he says. “But you shouldn’t think of it as ‘job done’. There are still many advances to be made, especially with regard to stability.”

Tomas Leijtens, co-founder and chief technology officer at Swift, says the company can now expose its cells to temperatures of up to 70°C while operating them in light without degradation. “This was something, I would say, unthinkable five years ago,” he says, sitting at a table adorned with a hot pink perovskite model.

But the industry needs to ensure that each cell is just as durable. Around the world, companies manufacture hundreds of millions of solar panels every year, each containing dozens of cells. Before being used in projects, panels must pass rigorous industry testing, such as withstanding rapid changes in temperature, humidity and hail. Swift, founded in 2017, has not yet begun independent testing; for now, she’s subjecting her cells to some of these conditions in her own lab and has a panel connected to her roof.

Startups like Swift and Oxford PV — a UK company created from a university research lab where some of Swift’s founders once worked — are working with the biggest companies in the sector to bring tandems to market. Oxford PV says it will begin shipping perovskite tandem panels to customers later this year. In May, Arizona-based First Solar, the largest U.S. solar power maker, bought a European perovskite company called Evolar.

In a statement about the Evolar acquisition, First Solar CEO Mark Widmar said the company believes “high-efficiency tandem photovoltaic modules will define the future.” A few days later, Korea-based Hanwha Q Cells, another major manufacturer, said it was investing $100 million to set up a tandem perovskite pilot line. In 2022, Q Cells helped start Pepperoni, a European collaboration to advance tandems.

Researchers working on perovskites say commercial tandem cells may be years, not decades, away. Jean says Swift hopes to have a product ready to be commercialized within four years. Incentives from the Reducing Inflation Act, which included credits for U.S.-made clean energy products, should help.

But perovskites have skeptics and supporters. Chase says current silicon panels are already good enough to help the world transition to clean energy and combat climate change. She has long questioned the ability of perovskites to change the status quo in the solar energy industry. “You can’t create semiconductor technology with momentum,” she says. “The technology needs to work.”

However, considering how much solar energy will be needed to decarbonize the grid, perovskite advocates say all the additional efficiency will be important.

“While it’s true that silicon is great, tandems are better,” says Leijtens. “In the fight to combat climate change, we need to accelerate, not just say, ‘Oh, that’s good enough, we’re done.’ Everything can continue to be improved.”

( source: MIT Technology Review )